It’s often said that necessity is the mother of invention, and this holds true for a seasoned veteran in the Australian mortgage broking sector who needed a one stop shop for accessing client data.

After almost 30 years of working in the finance and mortgage brokerage, Peter Smyth knew there had to be a better way of accessing all the information required to ensure effective servicing of customers. He envisaged an innovative, easy to use platform that put accurate, up-to-date data at the fingertips of brokers.

Another requirement for this concept? Ensuring productive back book management that would allow brokers to one day sell their business at a profit. Peter wanted a tool that allowed brokers to keep clients longer, while the book continued to grow, leading to increased profit.

Keeping customers longer while growing the business are fundamentals in any industry, but for brokers, where competition is plentiful and consumers have more choice than ever, it is essential.

The birth of Hound

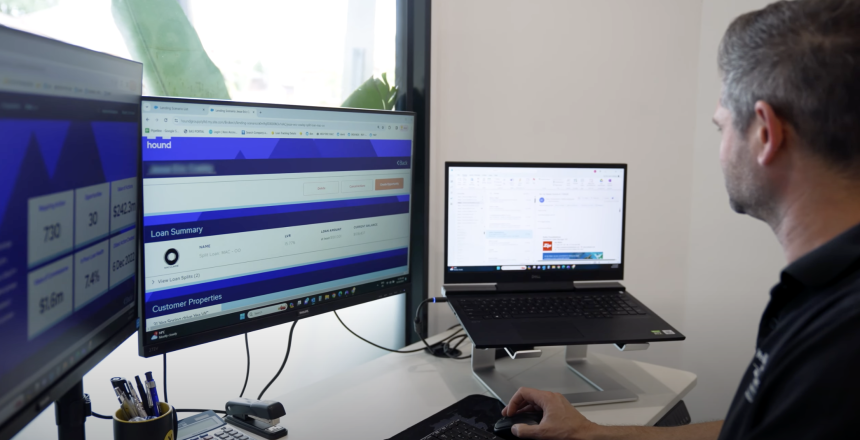

By working with experts, and through trial and error, Hound was born. The platform for mortgage brokers, with the broker in mind, is backed by the Hound team’s years of extensive management and governance experience in the financial sector.

“Hound picked up those loose pieces and created the platform, one area, where we could see interest rates, customers, property values,” he says.

“We produced our first prototype addressing what we figured would be the right way to go about it, then we needed to test it on something.

“We went to Yellow Brick Road and they were good enough to give us their orphan book to look at.”

That trial by fire, which involved extracting old data from different aggregators, transforming it and loading it on the platform, and testing triggers, provided valuable feedback.

“All of that worked very well.”

Refining the product and taking on user feedback resulted in the product that is available to Australian brokers now.

Helping brokers manage clients

YBR brokers, including Andrew Kalogirou, rely on Hound’s accurate, centralised, up to date data to manage clients in a timely, personalised way.

“I found Hound to be a great tool to use and of great value because it puts all of that data, that you can find, over hours and hours into one simple section, with one click of a button,” he says.

Managing client relationships is more efficient now too, he says, as it puts brokers on the front foot.

At the daily YBR meeting, staff look at Hound for priority items such as fixed rate expiry, interest only expiry and property up for sale. Andrew says the team ensures those three items are the primary focus for the team when contacting clients.

“Our customers have certainly noticed the difference. People are not having to pick up the phone to contact us about it, we’re contacting them.

“For us, it’s more of a proactive business model than a reactive one.”

In a competitive industry where every advantage matters, Hound is a testament to the enduring spirit of innovation. Through rigorous testing and refinement, Hound has not only proved its worth but also streamlined the way brokers manage their clients.

Watch how Andrew Kalogirou and brokers at Yellow Brick Road use Hound to manage their clients and business easily and efficiently.